Table Of Content

Most homebuyers have an escrow account, which is the account your lender uses to pay your property tax bill and homeowners insurance. Loan term (years) - This is the length of the mortgage you're considering. On the other hand, a homeowner who is refinancing may opt for a loan with a shorter repayment period, like 15 years. This is another common mortgage term that allows the borrower to save money by paying less total interest. However, monthly payments are higher on 15-year mortgages than 30-year ones, so it can be more of a stretch for the household budget, especially for first-time homebuyers. The answer depends on several factors including your interest rate, your down payment amount and how much of your income you’re comfortable putting toward your housing costs each month.

Get a more accurate estimate

The fees cover common charges, such as community space upkeep (such as the grass, community pool or other shared amenities) and building maintenance. In the drop down area, you have the option of selecting a 30-year fixed-rate mortgage, 15-year fixed-rate mortgage or 5/1 ARM. You can also try our home affordability calculator if you’re not sure how much money you should budget for a new home. Our partners cannot pay us to guarantee favorable reviews of their products or services. Loan amount - If you're getting a mortgage to buy a new home, you can find this number by subtracting your down payment from the home's price. If you're refinancing, this number will be the outstanding balance on your mortgage.

Terms explained

If you don’t consider them all, you may budget for one payment, only to find out that it’s much larger than you expected. You don’t have to accept the first terms you get from a lender. Try shopping around with other lenders to find a lower rate and keep your monthly mortgage payments as low as possible. To calculate your DTI, add all your monthly debt payments, such as credit card debt, student loans, alimony or child support, auto loans and projected mortgage payments. Use Zillow’s home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes, home insurance and HOA fees.

What is the average mortgage payment on a $300,000 house?

You may enter your own figures for property taxes, homeowners insurance and homeowners association fees, if you don’t wish to use NerdWallet’s estimates. Edit these figures by clicking on the amount currently displayed. An FHA loan is government-backed, insured by the Federal Housing Administration. FHA loans have looser requirements around credit scores and allow for low down payments. An FHA loan will come with mandatory mortgage insurance for the life of the loan. Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home.

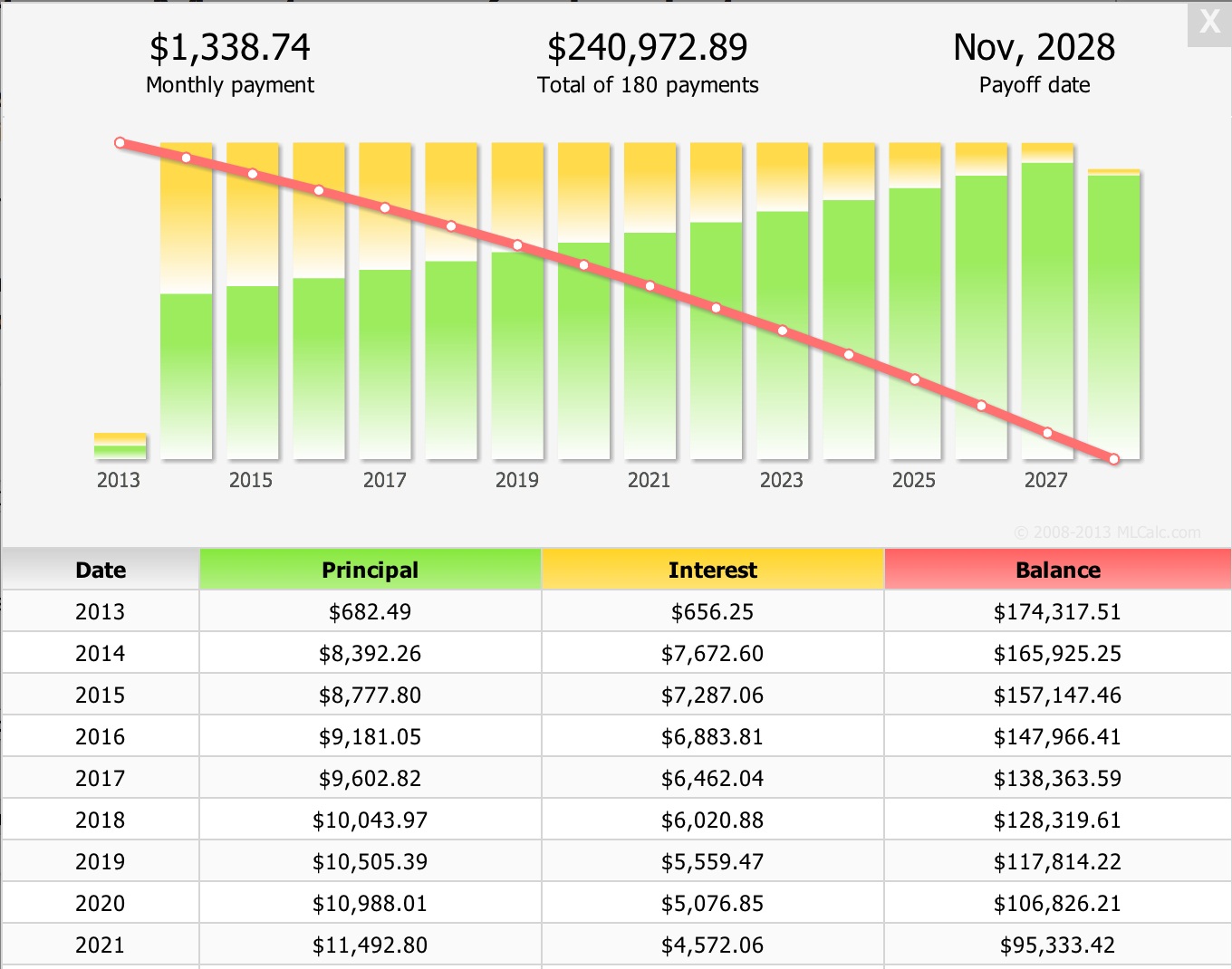

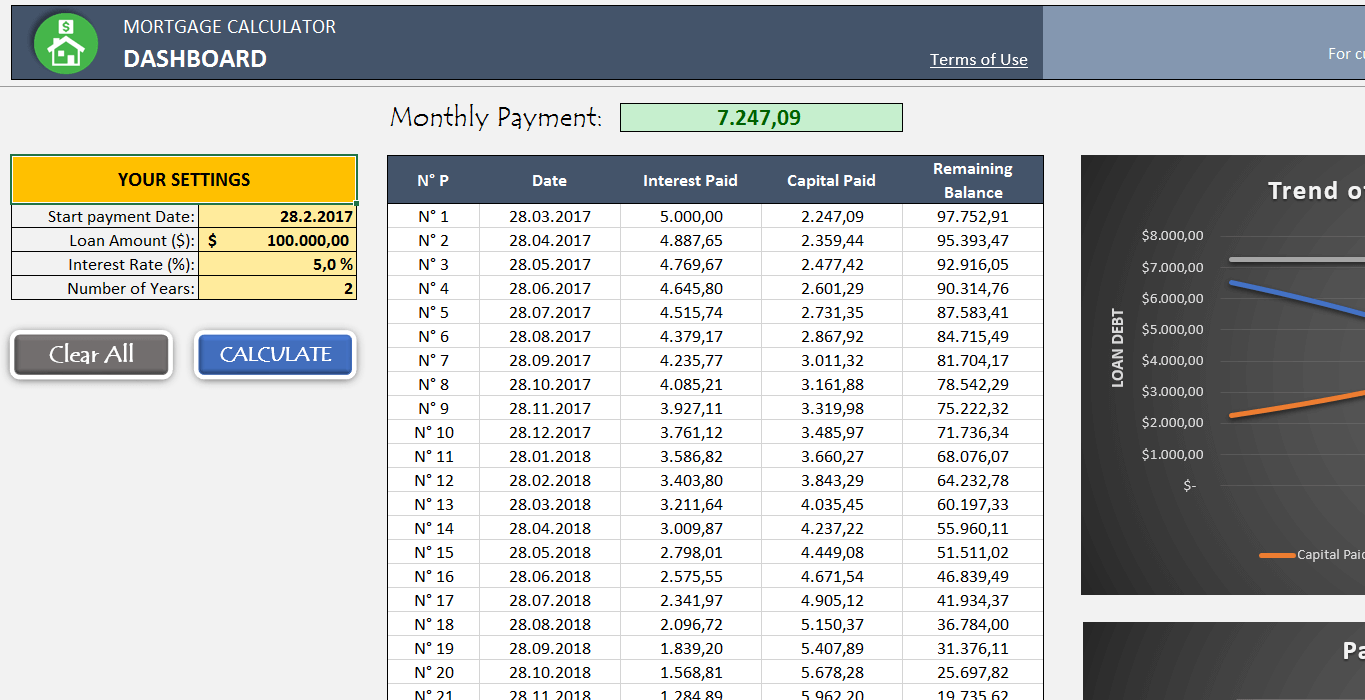

Monthly Pay: $2,181.88

Mortgage pre-approval is a statement from a lender who’s thoroughly reviewed your finances and decided to offer you a home loan up to a certain amount. Pre-approval is a smart step to take before making an offer on a home, because it will give you a clear idea of how much money you can borrow to pay for a house. Pre-approval is also a great way for you to stand out from other buyers in a competitive marketplace, since it proves to sellers that you can follow through on your offer and close the deal.

The calculator divides that total by 12 months to adjust your monthly mortgage payment. Average annual premiums usually cost less than 1% of the home price and protect your liability as the property owner and insure against hazards, loss, etc. An obvious but still important route to a lower monthly payment is to buy a more affordable home. If you don’t have enough saved for a 20% down payment, you’re going to pay more each month to secure the loan.

Oregon Mortgage Calculator - The Motley Fool

Oregon Mortgage Calculator.

Posted: Thu, 07 Mar 2024 08:00:00 GMT [source]

The United States Department of Agriculture backs USDA loans that benefit low-income borrowers purchasing in eligible, rural areas. While an upfront funding fee is required on these loans, your down payment can be as little as zero down without paying PMI. Mortgage interest is the cost you pay your lender each year to borrow their money, expressed as a percentage rate. The calculator auto-populates the current average interest rate.

Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. Adjust the loan details to fit your scenario more accurately. If other fees are rolled into your monthly mortgage payment, such as annual property taxes or homeowners association dues, there may be some fluctuation over time. A mortgage loan term is the maximum length of time you have to repay the loan. Longer terms usually have higher rates but lower monthly payments. Shorter terms help pay off loans quickly, saving on interest.

Free home loan calculator: Estimate the monthly payment breakdown for your mortgage loan, taxes and insurance

This rule says that your mortgage payment shouldn’t go over 28% of your monthly pre-tax income and 36% of your total debt. This ratio helps your lender understand your financial capacity to pay your mortgage each month. The higher the ratio, the less likely it is that you can afford the mortgage. SmartAsset’s mortgage payment calculator considers four factors - your home price, down payment, mortgage interest rate and loan type - to estimate how much you will pay each month. Here’s a breakdown with an explanation of each factor and how it influences your payment.

A down payment is a percentage of the purchase price of a home that the buyer pays upfront. Lenders will compare your income and debt in a figure known as your debt-to-income ratio. Your debt-to-income (DTI) ratio is the percentage of gross income (before taxes are taken out) that goes toward your debt.

Today, both entities continue to actively insure millions of single-family homes and other residential properties. To remedy this situation, the government created the Federal Housing Administration (FHA) and Fannie Mae in the 1930s to bring liquidity, stability, and affordability to the mortgage market. Both entities helped to bring 30-year mortgages with more modest down payments and universal construction standards. These are also the basic components of a mortgage calculator.

A mortgage is a loan secured by property, usually real estate property. Lenders define it as the money borrowed to pay for real estate. In essence, the lender helps the buyer pay the seller of a house, and the buyer agrees to repay the money borrowed over a period of time, usually 15 or 30 years in the U.S.

For most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner's insurance and taxes. If you have an escrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. SmartAsset’s mortgage calculator estimates your monthly mortgage payment, including your loan's principal, interest, taxes, homeowners insurance and private mortgage insurance (PMI). You can adjust the home price, down payment and mortgage terms to see how your monthly payment will change. The lump sum due each month to your mortgage lender breaks down into several different items.

If your loan amount is greater than 80% of the home purchase price, lenders require insurance on their investment. Your loan program can affect your interest rate and total monthly payments. Choose from 30-year fixed, 15-year fixed, and 5-year ARM loan scenarios in the calculator to see examples of how different loan terms mean different monthly payments. Most home loans require at least 3% of the price of the home as a down payment. Some loans, like VA loans and some USDA loans allow zero down. Although it's a myth that a 20% down payment is required to obtain a loan, keep in mind that the higher your down payment, the lower your monthly payment.

Assuming an interest rate of 6.9% and a down payment under 20%, you’d need to earn a minimum of $150,000 a year to qualify for a $400,000 mortgage. That’s because most lenders’ minimum mortgage requirements don’t usually allow you to take on a mortgage payment that would amount to more than 28% of your monthly income. The NerdWallet mortgage payment calculator cooks in all the costs that are wrapped into your monthly payment, including principal and interest, taxes and insurance.

A portion of the monthly payment is called the principal, which is the original amount borrowed. The other portion is the interest, which is the cost paid to the lender for using the money. There may be an escrow account involved to cover the cost of property taxes and insurance. The buyer cannot be considered the full owner of the mortgaged property until the last monthly payment is made. In the U.S., the most common mortgage loan is the conventional 30-year fixed-interest loan, which represents 70% to 90% of all mortgages. Mortgages are how most people are able to own homes in the U.S.

No comments:

Post a Comment