Table Of Content

But mortgage pre-approval does not last indefinitely, since your financial circumstances could change by the time you close your real estate deal. As such, you’ll want to know how long pre-approval lasts before it expires. This is based on our recommendation that your total monthly spend for your monthly payment and other debts should not exceed 36% of your monthly income. Amortization is the mathematical process that divides the money you owe into equal payments, accounting for your loan term and your interest rate. When a lender amortizes a loan, they create a schedule that tells you when each payment will be due and how much of each payment will go to principal versus interest. Use this loan calculator to determine your monthly payment for any loan.

How Your Mortgage Payment Is Calculated

The loan amount is the amount of money you plan to borrow from a lender. Once you have a loan, you pay it back in small increments every month over the span of years or even decades. It’s essentially a long, life-changing IOU that helps many Americans bring the dream of homeownership within reach. Over the length of the loan, though, the 15-year loan is a far better deal, considering the interest you pay — $514,715 in total. With the 30-year, you pay $646,624 total — over $100,000 more. Each month we’ll pay $2,859.53, over 60% more than with the 30-year loan.

Current Mortgage Rates by State

This means your interest rate and monthly payments stay the same over the course of the entire loan. Many mortgage lenders generally expect a 20% down payment for a conventional loan with no private mortgage insurance (PMI). A $2,000 per month mortgage payment is too much for borrowers earning under $92,400 a year, according to typical financial advice. A conservative or comfortable DTI ratio is usually considered to be anywhere from 1% to 26%, if you only include mortgage debt. A $2,000 per month mortgage payment represents a 26% DTI if you earn $92,400 per year.

Mortgage payment calculator

Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the "Include Options Below" checkbox. There are also optional inputs within the calculator for annual percentage increases under "More Options." Using these can result in more accurate calculations. A fixed rate is when your interest rate remains the same for your entire loan term. An adjustable rate stays the same for a predetermined length of time and then resets to a new interest rate on scheduled intervals.

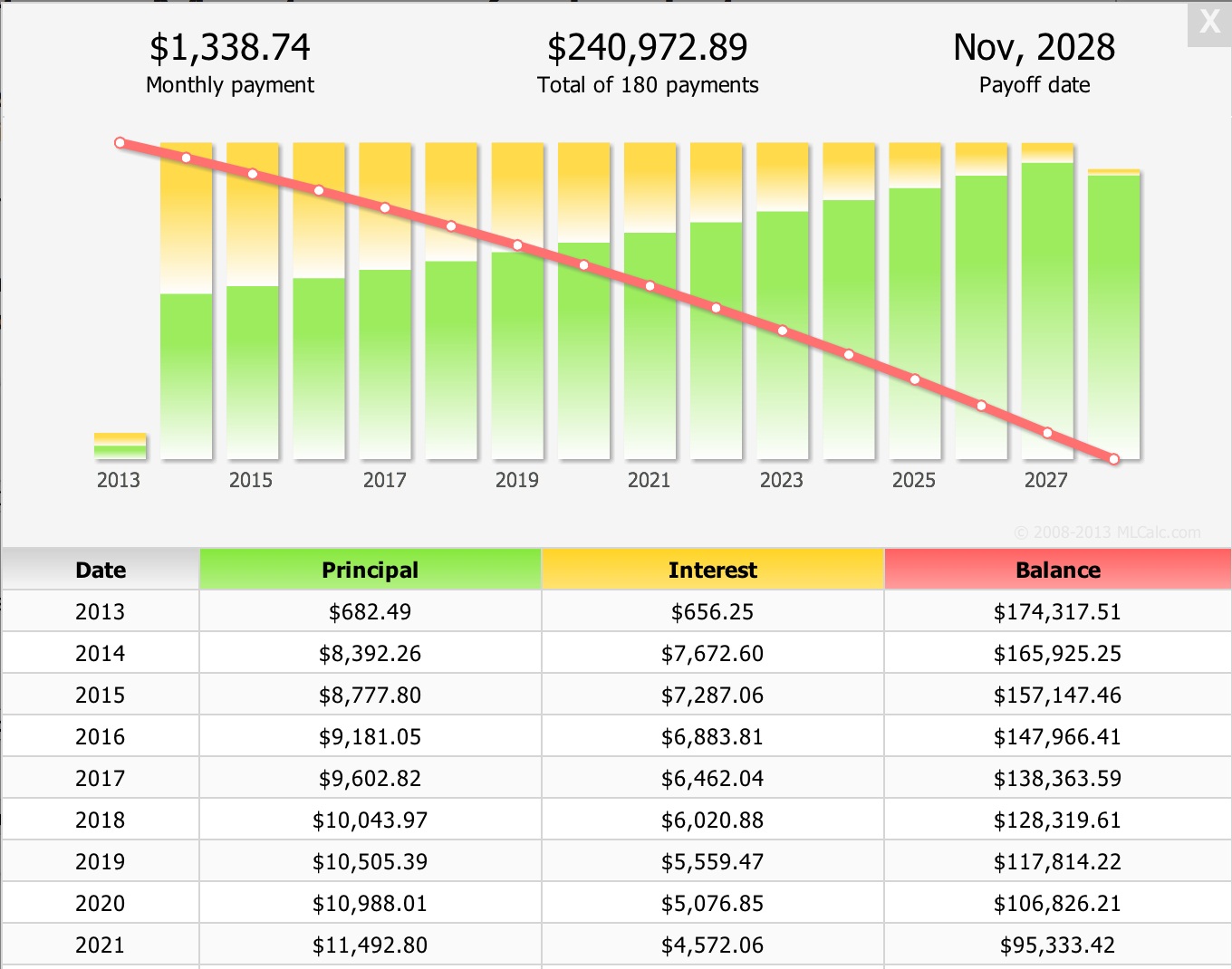

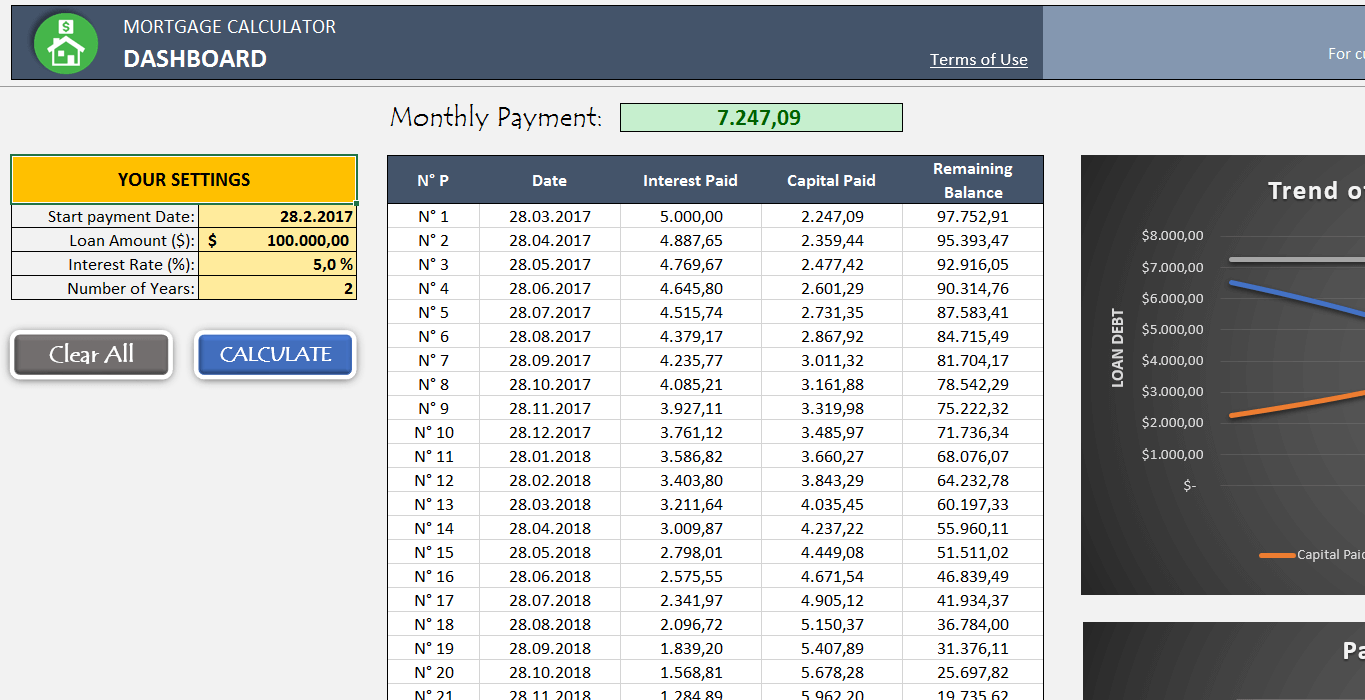

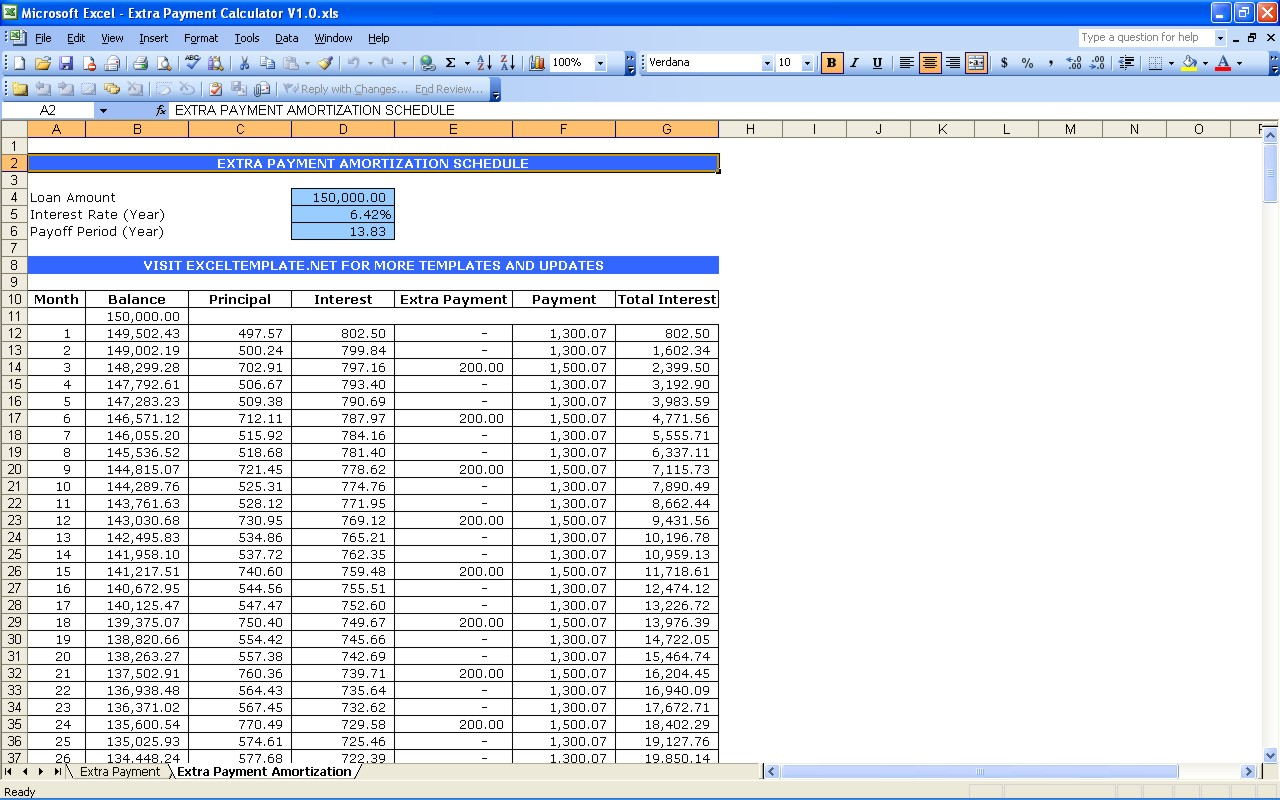

Click "Amortization" to see how the principal balance, principal paid (equity) and total interest paid change year by year. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Most recurring costs persist throughout and beyond the life of a mortgage.

Most people use a mortgage calculator to estimate the payment on a new mortgage, but it can be used for other purposes, too. In addition, the calculator allows you to input extra payments (under the “Amortization” tab). This can help you decide whether to prepay your mortgage and by how much. The FHA also offered further help amid the nationwide drop in real estate prices. It stepped in, claiming a higher percentage of mortgages amid backing by the Federal Reserve.

Adjustable-rate mortgage (ARM) loans are listed as an option in the [Loan Type] check boxes. Alternate loan durations can be selected and results can be filtered using the [Filter Results] button in the bottom left corner. You can select multiple durations at the same time to compare current rates and monthly payment amounts. NerdWallet’s mortgage payment calculator makes it easy to compare common loan types to see how each type of loan affects your monthly payment. We source the latest weekly national average interest rate from Zillow, so you can accurately estimate and compare your monthly payment for a 30-year fixed, 15-year fixed, and 5/1 ARM. Lenders look most favorably on debt-to-income ratios of 36% or less — or a maximum of $1,800 a month on an income of $5,000 a month before taxes.

Formula for calculating a mortgage payment

When all’s said and done, for a 30-year loan at 3.5% interest, we’ll pay $1,796.18 each month. Under "Home price," enter the price (if you're buying) or the current value (if you're refinancing). Escrow is a legal arrangement where a third party temporarily holds money on behalf of a buyer and seller in a real estate transaction. On desktop, under "Interest rate" (to the right), enter the rate. Under "Loan term," click the plus and minus signs to adjust the length of the mortgage in years.

Maine Mortgage Calculator - The Motley Fool

Maine Mortgage Calculator.

Posted: Tue, 23 Apr 2024 11:18:16 GMT [source]

Costs Associated with Home Ownership and Mortgages

To get the best mortgage interest rates and terms, you’ll want a down payment amounting to 20% of a home’s sale price. But if you don’t have 20%, you can put down as little as 3.5%, or in some cases 0%. Mortgage lenders are required to assess your ability to repay the amount you want to borrow. A lot of factors go into that assessment, and the main one is debt-to-income ratio. Loan start date - Select the month, day and year when your mortgage payments will start. If Joe were to abide by the 28/36 rule, he’d spend no more than $1,400 on a mortgage payment each month.

Often people do this to get better borrowing terms like lower interest rates. Refinancing requires a new loan application with your existing lender or a new one. Your lender will then re-evaluate your credit history and financial situation. Mortgage pre-approval should not be confused with mortgage pre-qualification, where you tell a lender about your income and debts but don’t provide documentation to verify your claims. A mortgage is a loan to help you cover the cost of buying a home. Paying a lower interest rate in those initial years could save hundreds of dollars each month that could fund other investments.

Mortgage Calculator: Estimate Your Monthly Payments - Business Insider

Mortgage Calculator: Estimate Your Monthly Payments.

Posted: Mon, 01 Apr 2024 07:00:00 GMT [source]

In general, following the introductory period, an ARM’s interest rate will change once a year. Depending on the economic climate, your rate can increase or decrease. Most lenders are required to max DTI ratios at 43%, not including government-backed loan programs. But if you know you can afford it and want a higher debt load, some loan programs — known as nonqualifying or “non-QM” loans — allow higher DTI ratios.

A 5-year ARM, for instance, offers a fixed interest rate for 5 years and then adjusts each year for the remaining length of the loan. Typically the first fixed period offers a low rate, making it beneficial if you plan to refinance or move before the first rate adjustment. The first two options, as their name indicates, are fixed-rate loans.